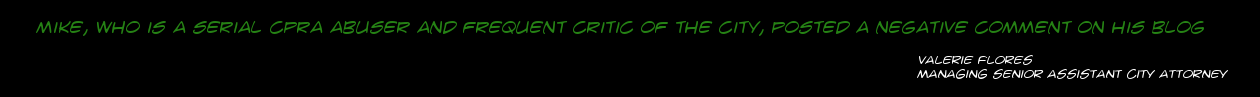

Los Angeles Police Chief Michel Moore apparently earned between $164.06 and $1,563.92 per day in 2021 from his investments in the stock market alone. This is a total of something between $35,600 and $339,370 from January 4, 2021 to August 5, 2021. Annualized it comes to between $59,881 and $570,830, which is a lot of damn money! That’s the news, and the rest of the post consists of me showing my work. I put all salient information into a spreadsheet if you want to check my method.

We start with Moore’s 2020 Form 700. These require disclosure of some information about the employees’s investments including names of the stocks and which of four ranges includes their fair market value. The ranges are as follows, with links to their Yahoo Finance pages showing the historical data I used in the calculations:

- $2,000—10,000

- $10,001—$100,000

- $100,001—$1,000,000

- Over $1,000,000

Moore discloses ownership of fourteen different stocks, all of them but one with aggregate values in one of the two lower ranges. Here they are along with links to their Yahoo Finance pages, which is where I obtained historical price data:

Moore's Stock Holdings (click to expand)

| Stock name |

Value range |

| Altria Group |

$2000—$10,000 |

| Emerson Electric |

$2000—$10,000 |

| Home Depot |

$10,001—$100,000 |

| Cisco Systems |

$10,001—$100,000 |

| Discover Financial Services |

$2000—$10,000 |

| Intel |

$100,001—$1,000,000 |

| Pfizer |

$2000—$10,000 |

| Kraft |

$2000—$10,000 |

| Philip Morris |

$10,001—$100,000 |

| Mondelez |

$2000—$10,000 |

| Royal Dutch Shell |

$10,001—$100,000 |

| Western Digital |

$10,001—$100,000 |

| Texas Instruments |

$10,001—$100,000 |

| Linde PLC |

$10,001—$100,000 |

And here are the prices on January 4, 2021, on August 5, 2021, and the percent change in value:

Moore's Stock Prices (click to expand)

| Stock |

1/4/21 price |

8/5/21 price |

Absolute change |

Relative change |

| Altria |

40.84 |

47.36 |

6.52 |

15.96% |

| Emerson Electric |

78.01 |

101.06 |

23.05 |

29.55% |

| Home Depot |

263.92 |

333.111 |

69.191 |

26.22% |

| Cisco |

43.96 |

55.76 |

11.8 |

26.84% |

| Discover Fin Serv |

89.61 |

127.1 |

37.49 |

41.84% |

| Intel |

49.67 |

53.89 |

4.22 |

8.5% |

| Pfizer |

36.81 |

45.06 |

8.25 |

22.41% |

| Kraft |

34.23 |

36.94 |

2.71 |

7.92% |

| Phillip Morris |

81.5 |

99.59 |

18.09 |

2.22% |

| Mondelez |

57.92 |

61.86 |

3.94 |

6.8% |

| Shell |

36.03 |

41.2 |

5.17 |

14.35% |

| Western Digital |

53.06 |

67.07 |

14.01 |

26.4% |

| Texas Instruments |

162.22 |

193.16 |

30.94 |

19.07% |

| Linde PLC |

258.81 |

304.83 |

46.02 |

17.78% |

All but one of Moore’s stocks pay dividends, which can be a significant part of investment income. Here are the dividend rates as of August 5, 2021:

Moore's dividend rates (click to expand)

| Stock |

Dividend |

| Altria |

7.26% |

| Emerson Electric |

2% |

| Home Depot |

2% |

| Cisco |

2.65% |

| Discover Fin Serv |

1.59% |

| Intel |

2.58% |

| Pfizer |

3.46% |

| Kraft |

4.33% |

| Phillip Morris |

4.82% |

| Mondelez |

2.27% |

| Shell |

3.67% |

| Western Digital |

N/A |

| Texas Instruments |

2.11% |

| Linde PLC |

1.39% |

And applying the percent change to the minimum and maximum values of each range of Moore’s holdings and adding twice the dividend yield shows his minimum and maximum investment gains, both total and daily, for 2021 through August 5:

Moore's min/max 2021 gains (click to expand)

| Stock |

Min 2021 gain |

Max 2021 gain |

| Altria |

$609.60 |

$3,048.00 |

| Emerson Electric |

$671.00 |

$3,355.00 |

| Home Depot |

$3,022.00 |

$30,220.00 |

| Cisco |

$3,214.00 |

$32,140.00 |

| Discover Fin Serv |

$900.40 |

$4,502.00 |

| Intel |

$13,660.00 |

$136,600.00 |

| Pfizer |

$586.60 |

$2,933.00 |

| Kraft |

$331.60 |

$1,658.00 |

| Phillip Morris |

$3,184.00 |

$31,840.00 |

| Mondelez |

$226.80 |

$1,134.00 |

| Shell |

$2,169.00 |

$21,690.00 |

| Western Digital |

$2,640.00 |

$26,400.00 |

| Texas Instruments |

$2,329.00 |

$23,290.00 |

| Linde PLC |

$2,056.00 |

$20,560.00 |

|

|

|

| Total |

$35,600.14 |

$339,370.00 |

|

|

|

|

Min daily gain: |

Max daily gain: |

|

$164.06 |

$1,563.92 |

As stated in the opening paragraph, these calculations show that Moore’s estimated 2021 investment gains through August 5, 2021 were between $35,600 and $339,370. August 5, 2021 was the 217th day of the year, so simple division shows that from investments alone in 2021 Moore earned between $164.06 and $1,563.92 per day in 2021 from investments alone.

This isn’t insignificant, by the way. According to Transparent California Moore earned $462,648.52 in salary and benefits in 2019, which is $1267.53 per day. At the top end of my estimate, then, Moore’s investment income adds more than 73% to his annual compensation. At the very least he’s increasing it by 13%.

Does this mean something? Certainly. Am I going to speculate? Certainly not. Like I said above I put all the figures into a spreadsheet so you can check my work if you want to. And that’s it. That’s the blog post!