⤕ Los Angeles Sunshine Coalition v. City of Los Angeles (CD4) — Council District 4 ignores requests and refuses to produce native format.

⤕ Los Angeles Sunshine Coalition v. City of Los Angeles (ITA) — The Information Technology Agency of the City of Los Angeles refuses to produce native formats and refuses to produce complete records.

⤕ Los Angeles Sunshine Coalition v. LAHSA — The Los Angeles Homeless Services Authority refuses to produce records in a timely manner and also ignores requests for years on end.

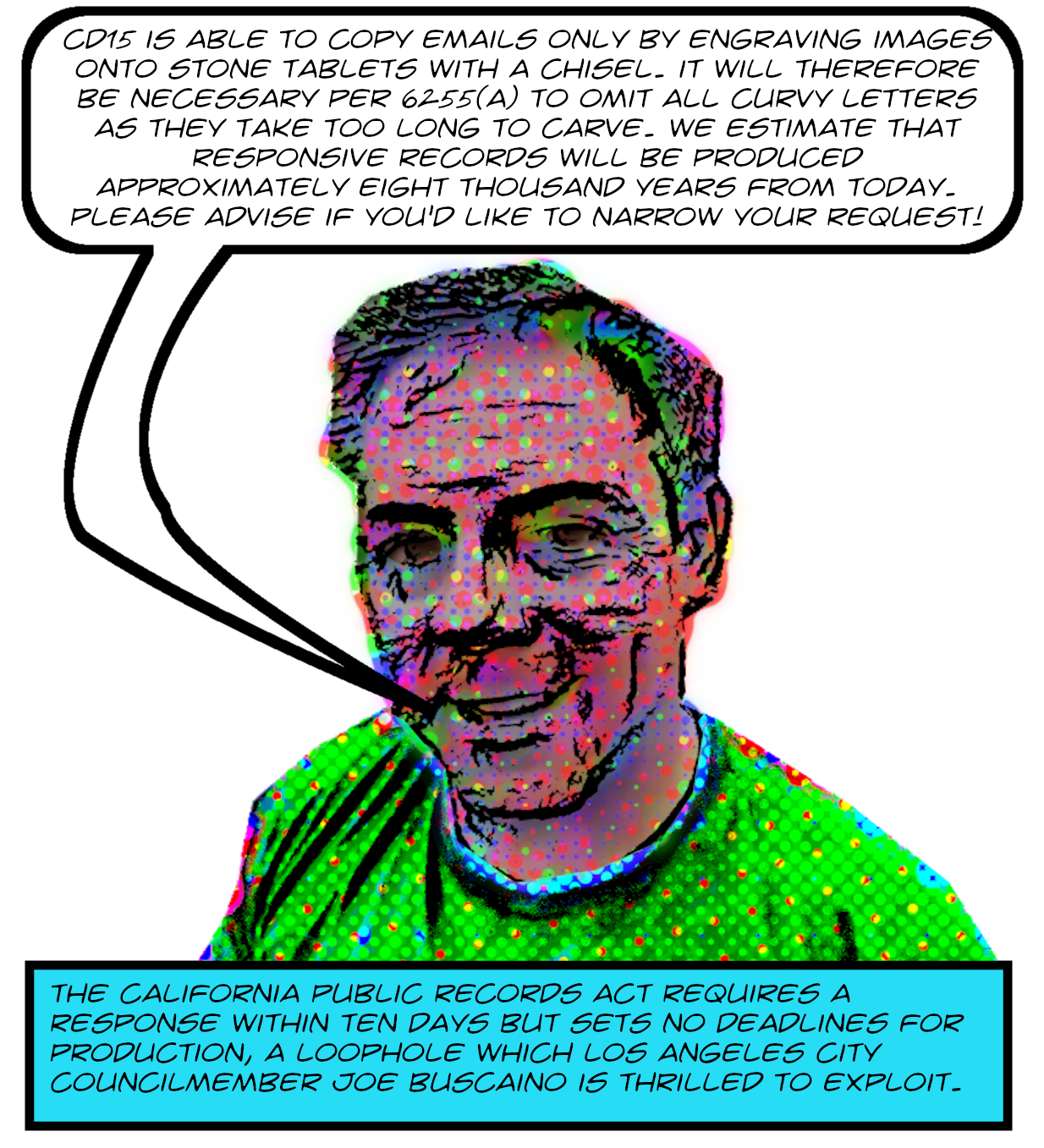

⤕ Riskin v. City of Los Angeles (CD15) — CD15 refuses to produce records in a timely manner and won’t produce native format. This one is also a taxpayer suit under the California Code of Civil Procedure at §526a, which is huge!

It’s been a big few days around here! The Los Angeles Sunshine Coalition filed two CPRA suits against the City of Los Angeles and one against LAHSA and I personally filed one against the City of Los Angeles. Both LASC and I are repped by the formidable Gina Hong of the Los Angeles Center for Community Law and Action.

The case against CD15 is based on a request I made in June 2019, for which, two years later, I’ve only received minimal responsives with no unexpired deadline for production forthcoming. Buscaino staffer Amy Gebert’s shameless violations of the CPRA led me to file two distinct complaints against her with the LA Ethics Commission, one in August 2020 and the other in February 2021.

This is an extremely exciting petition. It’s the first time I’ve used a cause of action based on California Code of Civil Procedure §526a, which allows taxpayers to file suit against government agencies for wasting tax money.1 The idea is that by insisting on producing emails by printing them in color on paper and then scanning the paper to PDFs CD15 is wasting staff time on unnecessary processes and public money on completely unnecessary color printing.

Not only is the printing unnecessary, it’s also contrary to the CPRA’s requirement that electronic files be produced in the formats in which the local agency stores them.2 One huge benefit of including a 526a action is that it’s possible to ask the judge to make the City stop wasting money on CPRA-violating policies, that is, to comply with the law in the future. This kind of relief is not readily available in the CPRA itself.3 In particular, and among other things, we ask:

The other three requests are more traditional in that they don’t involve CCCP 526a. Progressive darling Nithya Raman, for instance, ignores CPRA requests and also fails to produce emails in native format. The only recourse is a writ petition, and here it is! Did I mention LAHSA? They also ignore CPRA requests, and again the only recourse is a lawsuit, so we filed one and here’s your copy!

Finally, the Information Technology Agency of the City of LA refuses to produce email attachments in native format, including the detailed cell phone log of everyone’s favorite unindicted co-conspirator, Councilmember John Lee. Anyway, all four of the petitions are filed, and stay tuned for updates!

-

526a (a) An action to obtain a judgment, restraining and preventing any illegal expenditure of, waste of, or injury to, the estate, funds, or other property of a local agency, may be maintained against any officer thereof, or any agent, or other person, acting in its behalf, either by a resident therein, or by a corporation, who is assessed for and is liable to pay, or, within one year before the commencement of the action, has paid, a tax that funds the defendant local agency, including, but not limited to, the following:

(1) An income tax.

(2) A sales and use tax or transaction and use tax initially paid by a consumer to a retailer.

(3) A property tax, including a property tax paid by a tenant or lessee to a landlord or lessor pursuant to the terms of a written lease.

(4) A business license tax.

(b) This section does not affect any right of action in favor of a local agency, or any public officer; provided, that no injunction shall be granted restraining the offering for sale, sale, or issuance of any municipal bonds for public improvements or public utilities.

(c) An action brought pursuant to this section to enjoin a public improvement project shall take special precedence over all civil matters on the calendar of the court except those matters to which equal precedence on the calendar is granted by law.

(d) For purposes of this section, the following definitions apply:

(1) “Local agency” means a city, town, county, or city and county, or a district, public authority, or any other political subdivision in the state.

(2) “Resident” means a person who lives, works, owns property, or attends school in the jurisdiction of the defendant local agency.

- This requirement is found in the CPRA at §6253.9, which says in pertinent part: Each agency shall provide a copy of an electronic record in the format requested if the requested format is one that has been used by the agency to create copies for its own use or for provision to other agencies. The cost of duplication shall be limited to the direct cost of producing a copy of a record in an electronic format.

- It may be available in the CPRA itself. I don’t know because I’m not a lawyer, but whether or not the CPRA allows for prospective relief (lawyerese for relief extending into the future rather than just solving the already existing problems with nonproduction of records is irrelevant in Los Angeles County, where in my experience the assigned judges will not order prospective relief. In practice, with limited resources, what judges think the law says is more important than what it may actually say (or not, who knows? As I said, I’m not a lawyer).

- Who is the entire City of Los Angeles, by the way. Not just CD15. Like I said, this could be huge.