It’s well-known that the economic destruction wrought by the COVID-19 pandemic is putting already severely rent-burdened tenants at even greater risk of eviction and homelessness. Activists have been pleading with Los Angeles City officials for months now to find ways to mitigate this looming crisis while the officials spend their time whining about how they don’t have the power to solve the problem.

It’s well-known that the economic destruction wrought by the COVID-19 pandemic is putting already severely rent-burdened tenants at even greater risk of eviction and homelessness. Activists have been pleading with Los Angeles City officials for months now to find ways to mitigate this looming crisis while the officials spend their time whining about how they don’t have the power to solve the problem.

The very few measures the City has actually implemented are overly complex, slanted towards landlord interests, half-assed, and very likely to require court intervention as part of the process.1 Not only are the City’s putative solutions entirely insufficient to meet the looming need, but the City only allocated $100 million to the program, which is so inadequate an amount that the City is going to distribute it by lottery.

Our present situation highlights about as clearly as can be the complete contempt, or at least clueless indifference, with which City officials approach the needs of non-zillionaire angelenos. And it’s not just residential tenants that are economically endangered by the pandemic. It’s also been hell on retail businesses, who are also having possibly insurmountable problems covering the rent.

In turn this threatens the income of their zillionaire commercial-property-owning landlords, who are therefore worried about their ability to cover their own expenses, including mortgages and property taxes. But the City government of Los Angeles is neither contemptuous not cluelessly indifferent towards the interests of zillionaires, of course, and their lack of contempt is demonstrated clearly by their attitude toward business improvement district (“BID”) assessments in the City.

The City of Los Angeles has more than forty BIDs. These operations are funded by assessments paid by commercial property owners in the districts. The assessments are not voluntary. They appear on the owners’ county property tax bills and are subject to the same kinds of draconian collection measures used to enforce payment of any tax. But unlike ordinary property taxes, which are paid to and collectable by the County of Los Angeles, these BID assessments belong to the City.

Which I suppose gives City officials some power over how and when they’re collected, or at least that’s the only way I can make sense of a statement made by Dr. Kris Larson, executive director of the Hollywood Property Owners’ Alliance at their recent board meeting. Larson told his board that “while property owners are technically still on the hook to pay their assessments the City is not penalizing those that are late collected.”

I follow City Council agendas pretty closely and I haven’t seen anything about not penalizing commercial property owners for late BID assessment payment. This is almost certainly something the Mayor and/or the City Clerk2 implemented unilaterally using executive rather than legislative power. It was that easy for commercial property owners to get tax relief. No one had to agitate, demonstrate, plead, threaten, mock, or anything. The City saw two problems, very similar, and like a bad parent with a favorite child chose to solve only one of them.

And no one said anything about proving that payments were late due to the pandemic. No one seems to be suggesting that the City take late payers to court so they can prove they’re not just unjustified deadbeats. This is an easy program, designed to respect the autonomy and dignity of the debtors. Precisely the opposite of the punitive, intrusive, unworkable, burdensome system imposed by the City on tenants seeking what little relief is available.

Now I get that the two problems aren’t exactly parallel. In particular, it’s plausible that if the City controls the collection and enforcement of BID assessment payments then the City has the power to suspend them.3 But for the most part the City doesn’t own rental properties, so freezing or forgiving rent would require extra work, but it’s not impossible work, it’s work that’s just more complex.

And it wouldn’t have been impossible to make the two programs work well together. A lot of commercial property in BIDs is mixed use or residential4 and if the City is going to give landlords tax relief through not penalizing late payments it’s certainly not out of scale to condition it on meaningful rent relief for their tenants. And if the one can be imposed through executive power surely the other can as well. And yet it is not.

P.s. This is just a brief note on one thing that happened at this meeting, but it’s really, really, really not the only interesting thing that happened. You can see the whole hours-long mess here on YouTube and I hope to write at least one more post about it later in the week.

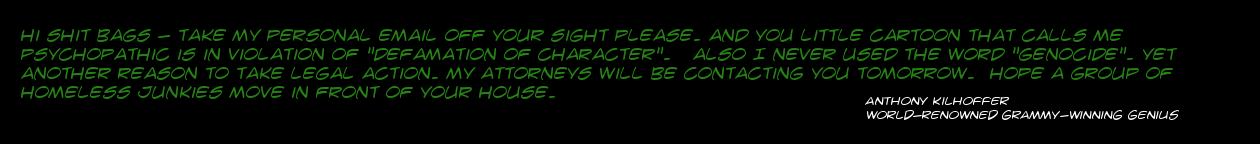

Image of Dr. Kris Larson is ©2020 MichaelKohlhaas.Org and now he’s just somebody that I used to know.

- Which is yet another way in which the program is slanted towards the interests of landlords, who not only can afford to hire lawyers but are familiar with legal processes. This is not to mention the many, many ways in which the court processes themselves are slanted towards the interests of landlords. Any process which is likely to end up in a courtroom is not a process favorable to the interests of tenants unless it includes a right to free legal representation, which none of the City’s actual programs do.

- Whose office oversees BIDs. That is, they provide what passes for oversight rather than actually overseeing.

- Although they’re County taxes in some way I don’t quite understand, so it’s not completely clear to me that the City does have this power or, if it does, why it does.

- The state law authorizing BIDs at §36632(c) exempts all property zoned residential from inclusion in BIDs and therefore from the payment of assessments. Through some kind of alchemy I don’t yet understand, though, sufficiently large residential properties are counted as business establishments where the business is being a landlord.